In this post our Vice President, Mike Iapalucci and Christian Rouffaert, Teragence CEO discuss how to use FiberLocator fiber location data as an input for evaluating locations for new data center construction.

Data Centers and Fiber

When it comes to data center location selection, access to power, water, and fiber make up the holy trinity of selection criteria (on top of actual land availability). FiberLocator’s comprehensive database of fiber and on-net buildings is an excellent source for understanding the fiber proximity aspect of this trinity.

In this blog post we will outline how FiberLocator leverages its comprehensive fiber database, combined with the H3 geographical indexing system to enable rapid data center site selection. In future posts we will outline how the same methodology can be used to assess the other parts of the trinity.

Fiber Selection for Data Center Locations

When it comes to fiber connectivity for data centers, there are 2 key selection criteria:

- Availability & proximity: to be cost effective, a data center location should be “near” an existing fiber network. With the “near” sweet spot being one mile or less, but occasionally distances up to 2 miles are deemed acceptable.

- Resiliency and redundancy: data centers, in all their aspects, are built to ensure continued operation under any circumstance. This means that they have resiliency and redundancy built into every aspect of their operation – including connectivity. So, access to multiple fiber providers is key.

Having established these criteria, the next question is how to apply them. We could use FiberLocator to visually inspect each location and assess them against these criteria. However, this would be more costly and time consuming. We want a system to zoom on promising locations and ignore “no hopers” so that users can focus their energy and get maximum “bang for the buck”.

Cue FiberLocator’s hexagonal indexing system.

Why H3 Hexagonal Indexing

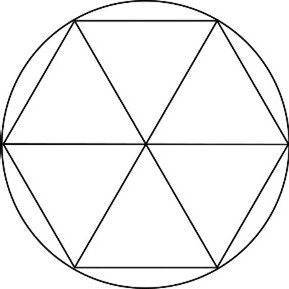

Hexagonal indexing is ideal for this type of analysis. Hexagons offer some convenient features for GIS analysis. They are regular polygons that are the closest thing to a circle, without being a circle. This means that we can talk about the radius of a hexagon being consistent with the edge of a circle centered in the hexagon and touching each of the outside vertices.

(For more information see the previous post FCC Broadband Coverage Data and FiberLocator – How do they compare?)

Source: Uber Blog1

Analyzing Proximity to Fiber with H3 Hexagonal Indexing

Let’s now move from theory to practice. To do this, we will focus on Charlotte, NC. CBRE, the global commercial real-estate firm, identified it as a datacenter hotspot due to local tax incentives, available land, and greater power accessibility.

Below is a map of Mecklenburg County that includes the greater Charlotte region.

Source: Author using FiberLocator data in ArcGIS Pro.

Every hexagon is colored to indicate the fiber availability in that area, from dark green indicating many fiber providers to light green (zero-1) fiber providers)

Looking at the map, we see that most of the county is covered in light green hexagons indicating no fiber availability or at best a single provider. Since we are interested in having at least two different providers available for redundancy, we can limit our search to those areas with hexagons that are darker shades of green having the highest number of providers.

For this analysis we used resolution 8 hexagons – meaning they with have a radius of 0.33 miles. So, the maximum distance to any fiber network within the hexagon is 0.66 miles, comfortably within the 2-mile limit. In fact, any location in a darker green hexagon or an adjacent hexagon will be within the 2-mile radius (and what’s even better, there are standard API’s and libraries to identify adjacent hexagons).

We can extend this analysis to a larger area just by increasing the number of hexagons displayed on the map. The nice thing about H3 hexagons is that they are standardized in terms of their location and have unique identifiers so they can be easily joined with other data sets. For example, we can summarize the availability of power lines and substations in each hexagon and overlay these data on the map. We can combine the data from both fiber and power related hexagons to identify locations that have these two necessary data center inputs and further tighten our selection and zoom in on the most promising locations

And this is just what we will do in part 2 of this blog series. We will layer in power lines and summarize and combine it with fiber to get a better picture of where we might find good locations for new data center builds in the Charlotte market.

If you want to know more about FiberLocator data and using H3 hexagon indexing, contact us at support@fiberlocator.com.

Sources

1 https://www.uber.com/en-FI/blog/h3/

2 https://www.cbre.com/insights/reports/north-america-data-center-trends-h2-2024